By Amy Cockerham

Public Ed Works

(RALEIGH) – While North Carolina school systems are grappling with underfunding, corporations and millionaires are paying less and less taxes.

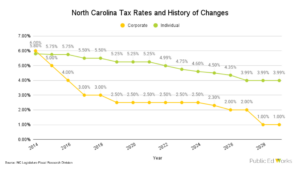

Corporate tax rates were reduced from a 6.9% rate in 2012 to 2.3% and are planned to drop to 0% by 2030. In the year 2000, the rate was 7%.

Funds from corporate taxes flow into the N.C. General Fund and are spent on public services, the largest one being public education.

Kris Nordstrom is a Senior Policy Analyst with the North Carolina Justice Center. He said tax cuts are severely harming education.

“That’s what’s driven down our school funding level, is that we’ve provided wealthy families and corporations tax cuts that are really being paid for on the backs of public school students,” Nordstrom said. “Other states haven’t made that choice, and that’s why we’ve plummeted down the rankings while other states have…used their growing economies and recovering economies to reinvest in the public school system.”

North Carolina imposes less taxes on corporations than most other states, ranking at #45. Although, the state does impose a franchise tax, which is considered an economically harmful tax that is payable even if the corporation does not turn a profit and reduces the incentive for new investments.

Tom Oxholm is a retired Executive Vice President of Wake Stone Corporation. He said funding issues started around the Great Recession.

“In 2010, we made major cuts to the biggest expense in our budget, which is public education. Cutting supplies, cutting textbooks to a dollar per student per year, cutting teacher assistance, cutting, cutting, cutting as they had to do, and when the economy turned around and came back, instead of restoring those allocations for psychologists, social workers, etc. those have never been restored.”

Now, we are cutting taxes even further. All while teachers deal with low pay, lack of supplies, among other financial barriers. Oxholm said businesses suffer from the decline of public education too.

“Never met as a CPA, in my nine years in public accounting, or in all my years in business, a business person that said, “We’ve got to plan around this state income tax because it’s really a beast. Yep. Whereas they all say, ‘How can we get better educated workers?’”

An even larger portion of money for education comes from income taxes.

Over 40 percent of the General Fund in Fiscal Year 2022-23, or $15.5 billion, came from personal income taxes. Another five percent comes from corporate income and franchise taxes.

The 2025 state individual income tax rate is 4.5%, which is down from 5.25% in 2021. As part of previously passed legislation, this tax rate will decline to 4.25% in 2026, and 3.99% for the years 2026 and beyond.

This budget cycle, North Carolina Governor Josh Stein proposed freezing individual and corporate tax cuts.

“They are recognizing the landscape that is ahead of us,” Public School Forum’s Associate Director of Policy & Research Sara Howell said. “They know what we’re heading towards and they’re saying, ‘Let’s at least pause it.’ The governor’s budget has proposed reversing the tax cuts to make sure we have enough state revenue to pay for the services and goods that, you know, our citizens rely on.”

Months behind schedule, the North Carolina legislature has yet to set the 2025-2027 budget.

This is the latest installment of our “Lessons Learned” series aiming to address how legislative actions – and inaction – in North Carolina over the past few decades have contributed to harm in our public schools. For a chronicle of our previous work, click here.

David Gellatly says

Left unsaid are several critical points: the actual amount of funding for public education, rate and direction of changes in the levels of total public funding, changes in academic performance levels, the $ amount of revenue raised by each tax (and other taxes such as sales taxes, etc.) year on year; and changes in sources of revenue devoted to public education such as the amount of lottery revenue available to public school and district level funding.

Also left unsaid is the basic fact that there is little or no correlation between the level of funding and educational achievement. For example, New York state spends 3 times as much per capita on public education than North Carolina ($30,000 vs. NC’s $10,000) placing it as #1 in funding, yet North Carolina, ranking #48 in funding, out performs New York in student achievement levels – although there is a significant room for improvement in North Carolina’s performance.

All we are presented with in this article are the facts that tax rates are going down and the educational establishment wants more money, as always.